Valuation Analysis:

Data Intelligence

Standard executive incentive structures have not evolved with changes in capital markets, leaving IR professionals, management teams and boards in a difficult position. This creates pressure to improve share price in the short-term, only to be in the same position a few quarters later. This vicious cycle is difficult to manage and maintain.

We see a better way.

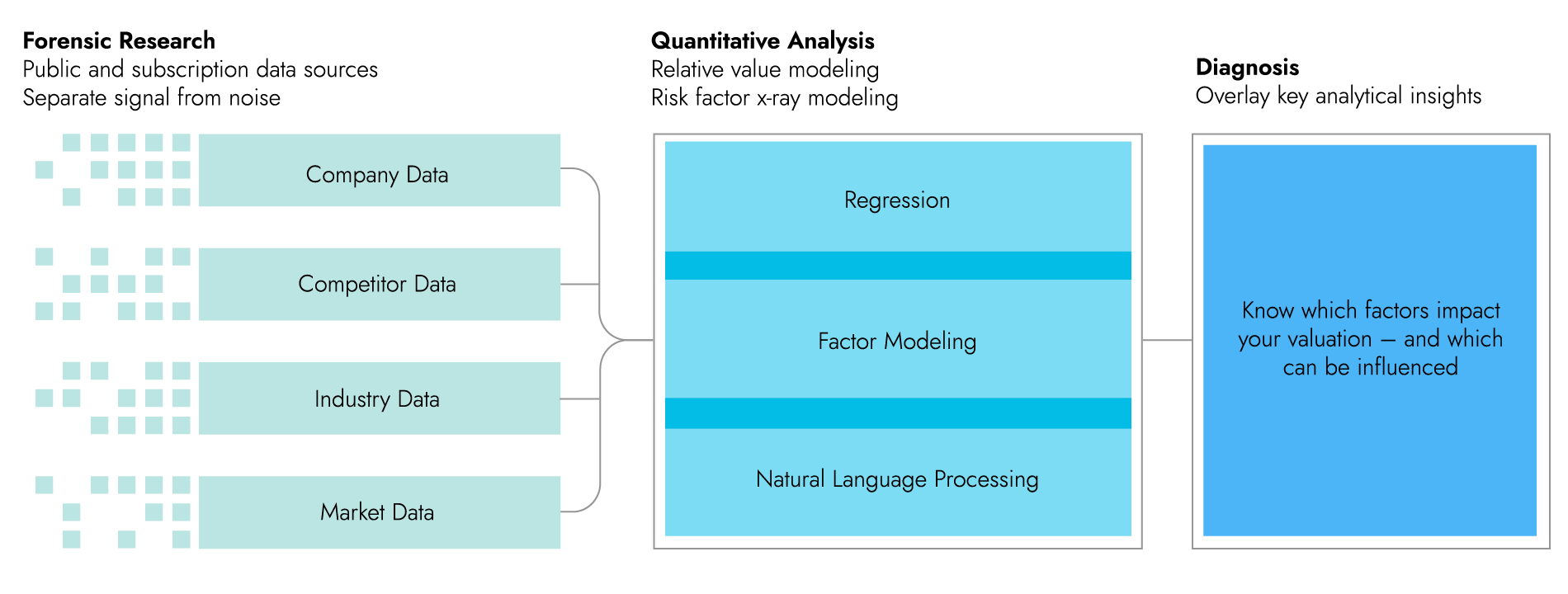

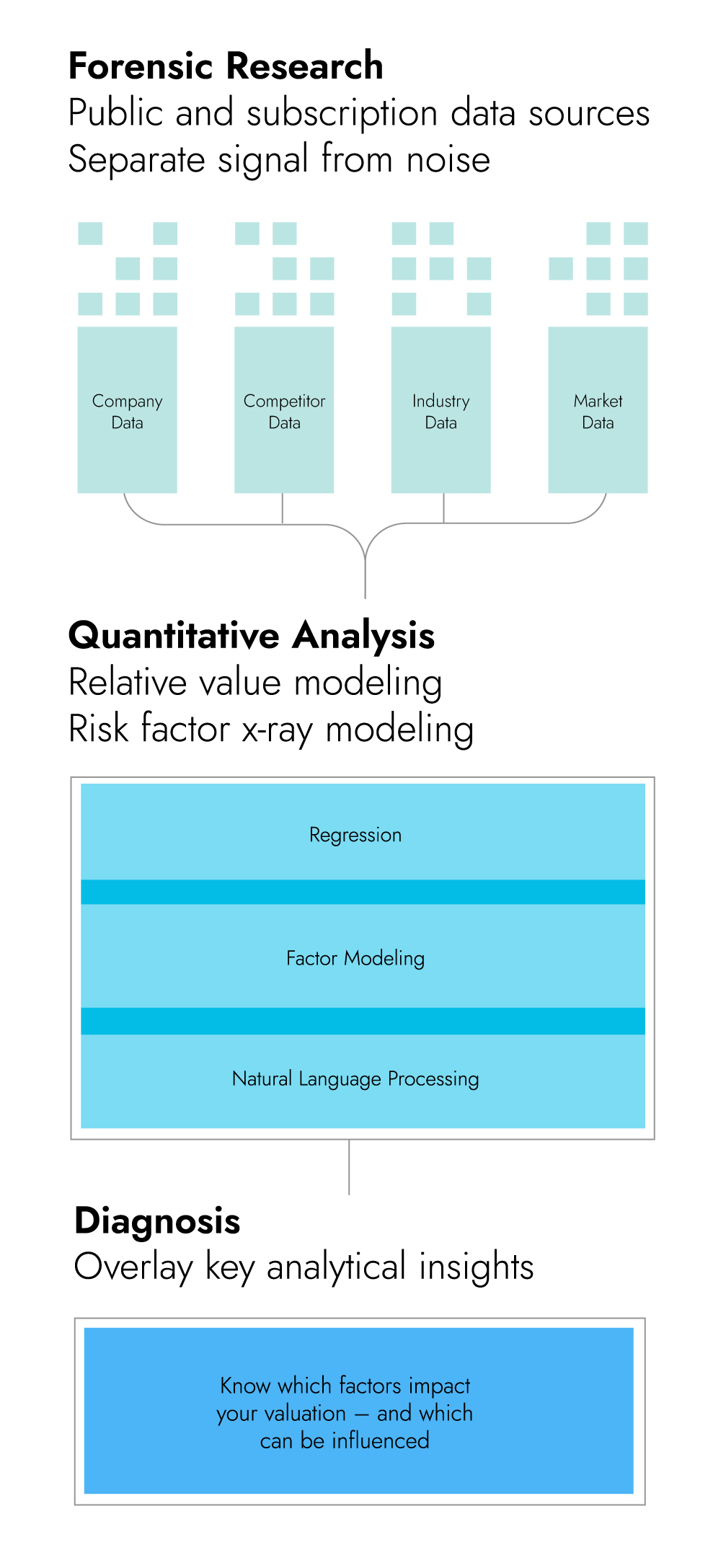

BETTER OUTCOMES REQUIRE TECHNOLOGY AND ANALYTICAL EXPERTISE

We’ve partnered with Anduril Partners to deliver intelligence on how changes in market factors are impacting your share price. This intelligence is gathered through regression analysis and factor-based investing techniques and is then analyzed using data intelligence and analytics to deliver insights you can share with your board and management team.

You will be able to isolate company-specific contributors, save valuable time and energy, and make thoughtful decisions that support your long-term strategy and values – with confidence.

The right message,

the right audience,

the right valuation.

We highlight ways to capture value with the highest probability of success. This includes strategy resolution, defining objectives and key results (OKRs) and attaching leading key performance indicators (KPIs). We then pivot investor focus towards your future state as supported by empirical research and benchmark inputs from Wall Street and top consulting centers.

We’ll deliver an action plan to attract the right investors and help the market fairly value your company. From there, we link your strategy to demonstrable KPIs that communicate your conviction to investors.

This approach should result in a broader shareholder base, clear goals and an actionable plan. The right message, the right audience, the right valuation.

When we engaged Arbor Advisory Group, we were seeking to better understand our valuation relative to peers, gain insight as to the drivers and implement a strategy to attract new investors in our company. The Arbor team leveraged data analytics tools to provide the insight that we were seeking, helped us understand which drivers of valuation are within our control, how the Street was viewing our company and identified steps to drive a more proactive investor relations program. They have dived into our strategy, assessed our competitive strengths and are driving our program forward on an outsourced basis.

Sandra Beaver, Chief Financial Officer, Evolus