Investor relations (IR) professionals are grappling with a complex and rapidly shifting economic environment driven by significant shifts in trade policy. A volatile market, cautious investor sentiment and heightened uncertainty under the current U.S. administration have created a pullback in both capital deployment and engagement.

Investor relations (IR) professionals are grappling with a complex and rapidly shifting economic environment driven by significant shifts in trade policy. A volatile market, cautious investor sentiment and heightened uncertainty under the current U.S. administration have created a pullback in both capital deployment and engagement.

Investors are scrutinizing opportunities, and the strongest IR strategies are grounded in fundamentals, credibility and transparency.

That means understanding the true drivers of valuation, identifying and communicating the right data points and refining your corporate narrative with a clear strategy to manage through uncertainty. It means staying visible – leveraging channels such as video and digital platforms to maintain connection and visibility, even when investors aren’t ready to engage.

Trust, transparency, strategic clarity and consistent communication are the tools that will help companies stand out amid the noise.

The Defining Challenge for IR in 2025: Investor Pullbacks in an Erratic Market

The resurgence of protectionist policies under the current U.S. administration has led to unpredictable tariff implementations, creating widespread global uncertainty. Companies are grappling with trade policies that disrupt supply chains and inflate costs, making strategic planning increasingly complex.

Compounding these policy-specific issues is a broader decline in consumer sentiment. According to the University of Michigan’s Consumer Sentiment Index, consumer sentiment for the U.S. dropped to 50.8 in April, the lowest since 2022. When consumers lack the confidence to spend, companies can’t sell their products or services, which in turn lowers investor confidence and brings growth strategies to a standstill.

This climate of unpredictability has heightened investor anxiety, leading to reduced engagement and a cautious approach to new investments. In this environment, it is even more important for IR professionals to maintain their company’s visibility and investor confidence.

With traditional valuation drivers becoming more opaque due to market distortions, effectively communicating a company’s capabilities to manage uncertainty, intrinsic value and long-term prospects is even more paramount.

The Key to Sustained Investor Engagement: Returning to Fundamentals

In uncertain times, a return to the core principles of investor relations is crucial to maintaining engagement and communicating your company’s strategy. But what are those fundamentals? Principles such as trust and transparency, prioritizing data intelligence and maintaining open communications are all key tenets of your IR strategy.

Transparency is vital in building and maintaining investor trust. Providing clear, relevant data, including insights into risk management practices and strategies to mitigate potential downturn impacts, can help reduce information asymmetry. During economic downturns, effective communication with investors is essential to assuage investor concerns.

Crafting a compelling narrative aligned with current market realities can differentiate your company in a crowded marketplace. This narrative should address how your company is adapting to challenges and positioning itself for future growth.

Leveraging modern communication platforms, such as video, enhances engagement. Video allows for personal and immediate connections with investors, a vital tool that can capture some of the spirit of face-to-face meetings.

By refocusing on these fundamentals, IR professionals can strengthen their company’s position, ensuring they remain on investors’ radars. Ultimately, your goal is to stay top of mind for your investor base so they believe in your vision for the long-term, and they see your company’s value proposition even in the midst of uncertainty.

What Does This Really Mean for Investor Relations Leaders?

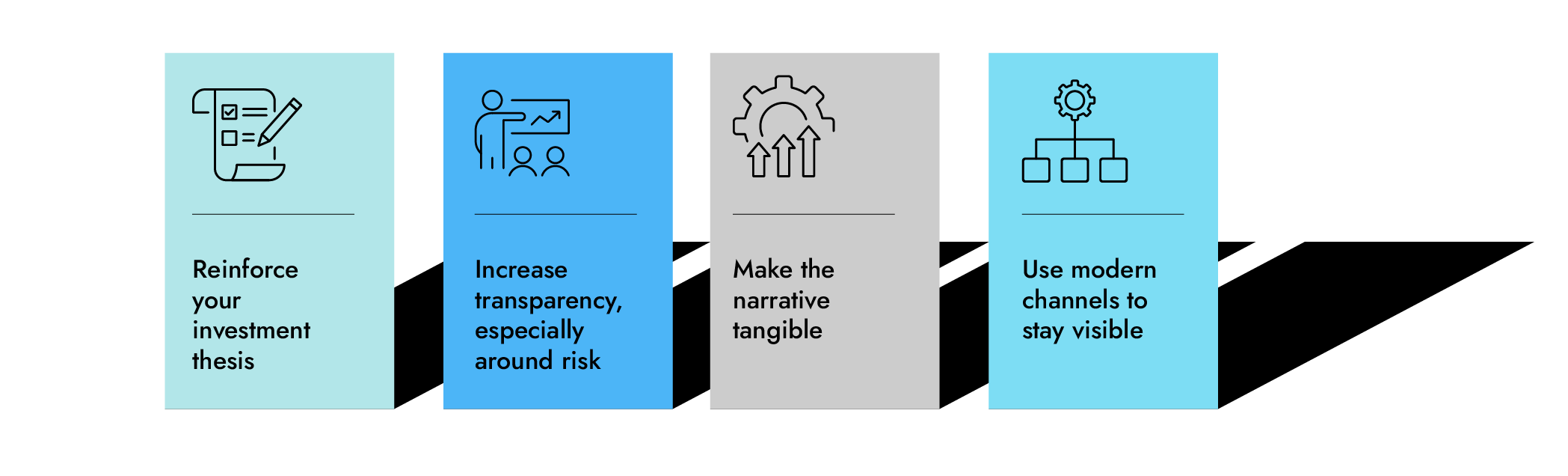

- Reinforce your investment thesis: Ground your investor communications in your core valuation drivers. Revisit and refine your investment thesis to ensure it speaks to the current market context and challenges. What makes your business resilient? How do your growth levers align with long-term trends? Those are the questions investors will be asking, and your answers should be crisp, credible and consistent in all your communications.

- Increase transparency, especially around risk: Certain investors are inclined to reward companies that are honest about challenges and clear about mitigation strategies in uncertain climates. Be proactive in discussing potential headwinds and show how your company is managing through them. This not only builds trust but also demonstrates your company’s effective leadership.

- Make the narrative tangible: Numbers matter, as does the storytelling. Help investors understand the “why” behind your strategy, not just the “what.” Tie your financial performance, operational metrics and data analysis back to a clear narrative about where the company is headed, how it’s getting there and why it will succeed.

- Use modern channels to stay visible: Investors may not be ready to invest in a downturn, but they’re listening. Use video, meeting platforms and social media to maintain a steady cadence of updates and insights. Your visibility is critical for engagement from your investor base when the market normalizes.

Communicate and Maximize Value In a Discounted Market

While today’s market is marked by caution and suppressed valuations, that also means many companies are currently undervalued. The companies that will gain the most in a recovery are those who can clearly articulate their intrinsic value today.

Investor relations isn’t about reacting to market conditions – it’s about shaping investor perception through consistency, clarity and conviction. In a market defined by uncertainty, companies that stay grounded in the fundamentals could be among the first to see valuations increase when sentiment shifts.

Contact us to learn more about how Arbor can help protect your valuation.