From liquidity pressures and operational failures to reputational threats, investor relations (IR) professionals are at the front lines of managing perception and safeguarding trust. Proper preparation and consistent communication are paramount.

From liquidity pressures and operational failures to reputational threats, investor relations (IR) professionals are at the front lines of managing perception and safeguarding trust. Proper preparation and consistent communication are paramount.

What Can Trigger a Crisis in Investor Communications?

Crisis events can be caused by a range of triggers – financial, strategic or operational. Each requires a unique communications strategy, but they all share one thing: the potential to disrupt investor confidence if not handled transparently and swiftly.

Financial-Related Crises

1. Earnings Misses or Withdrawn Guidance

When a company misses its earnings target or pulls previously issued guidance, it sends an immediate signal to the market that the business is underperforming. If not provided context, investors may question the company’s financial health, leadership credibility and overall trajectory. Even when there are legitimate reasons behind the development, investors often assume the worst unless there is a clear explanation.

Example: Macy’s delayed its third quarter earnings in 2024 after discovering that an employee hid up to $154 million in expenses. They reported preliminary earnings and provided a full explanation, so while they still needed to answer to the accounting error and their internal practices, there was no investor speculation.

2. Unexpected Capital Decisions

When companies announce significant capital allocation changes, such as slashing dividends, halting buybacks or initiating unexpected capital raises, it can trigger alarm. These decisions can appear reactionary and unsettle long-term shareholders, especially if they’re not accompanied by a strategic rationale.

Example: In 2023, Silicon Valley Bank announced losses and a capital raise on their quarterly earnings call. The timing and lack of framing triggered a $42 billion bank run and liquidated the bank.

3. Restatements or Accounting Irregularities

Few events alarm investors more than a financial restatement or the discovery of accounting irregularities. They can break the foundational trust in a company’s reporting accuracy and internal controls. Often, they invite regulatory investigations, class-action lawsuits and executive turnover.

Example: Cryptocurrency firm FTX collapsed in late 2022, following allegations that its owners had embezzled and misused customer funds. The aftermath revealed a stunning lack of internal controls: no audit committee, board meetings or internal auditing. Eventually, founder Sam Bankman-Fried was sentenced to 25 years in prison.

4. Short Attacks

Short-seller campaigns can be devastating, particularly when they involve public reports filled with distorted or misleading claims. These attacks can dominate financial media coverage and cause a company’s stock to significantly drop. Even if the claims are eventually debunked, the reputational damage can linger.

Example: A report by the short-seller Culper Research led to a drop in stock price for Zeta Global. The company immediately launched countermeasures by issuing a press release to state the facts with respect to each of the claims and then quickly orchestrated an Investor Day to reaffirm its long-term strategy with stakeholders.

Strategic, Leadership and Operational Crises

5. Leadership Change or Reputational Scandals

Leadership transitions – especially those that happen abruptly or controversially – can deeply unsettle investors – and rightly so. A surprise departure may be interpreted as a red flag for broader instability, and scandals can quickly snowball into governance crises.

Example: WeWork CEO Adam Neumann had gained a reputation for his bizarre ideas. When pre-IPO filings revealed that he was treating the company as his own personal piggy bank, he lasted just six weeks before voting to remove himself as CEO. By then, the company’s valuation had fallen by half, and the IPO had failed.

6. Regulatory Investigations or Legal Challenges

When federal agencies such as the SEC or DOJ announce investigations, it can dominate headlines and investor sentiment. Regulatory involvement – particularly in cases related to fraud or disclosure – can negatively affect a stock’s price before any conclusions are reached. Legal risks and the perception of poor compliance often compound the crisis.

Example: Frances Haugen’s whistleblower revelations about harmful practices at Facebook triggered Congressional hearings and stock declines. The renewed scrutiny into the company’s oversight practices noticeably impacted investor sentiment in the process.

7. Operational Disruptions

Disruptions such as product recalls, cybersecurity failures or supply chain breakdowns can immediately impact performance and market confidence. Since these issues are often highly visible to customers, they carry reputational risks that extend well beyond the balance sheet.

Example: CrowdStrike deployed a software update in July 2024 that triggered a global Microsoft Windows outage, leading to questions around its operational stability and risk mitigation practices.

8. Activist Campaigns and Hostile M&A Activity

Activist investors and hostile takeover attempts can upend focus and introduce volatility. They may challenge leadership competence, demand restructuring or call for asset divestitures – forcing the company into a defensive posture in front of its shareholders.

Example: Jana Partners, an investor in Freshpet, Inc., pushed for aggressive leadership changes at the company after the stock fell by 74%. The firm gained four board seats in May 2023 and they’ve since advocated for changes in capital allocation and corporate governance.

The Path Forward is Not Avoidance But Transparency

Crises are rarely resolved by waiting them out. When companies withhold information, delay responses or downplay the severity of events, they often find themselves dealing with long-term reputational harm rather than short-term volatility. Transparency builds resilience – even in the face of uncomfortable truths.

Transparency is not easy. Executive teams may fear legal liability or backlash from the media, the market, their customers and even their own employees. But when trying to cover up the issues, the fallout is much worse.

According to Boston Consulting Group, only 2% of companies studied saw a meaningful rebound in trust in the quarter following a trust breach. Once lost, trust is hard to gain back. The companies that successfully earned trust back tended to demonstrate competence – what BCG defines as consistently fulfilling promises to stakeholders.

Transparency means acknowledging mistakes, explaining the corrective actions and committing to improved oversight. Whether the issue is a rogue employee or a defective product, investors want to understand what went wrong – and what’s being done to prevent it from happening again.

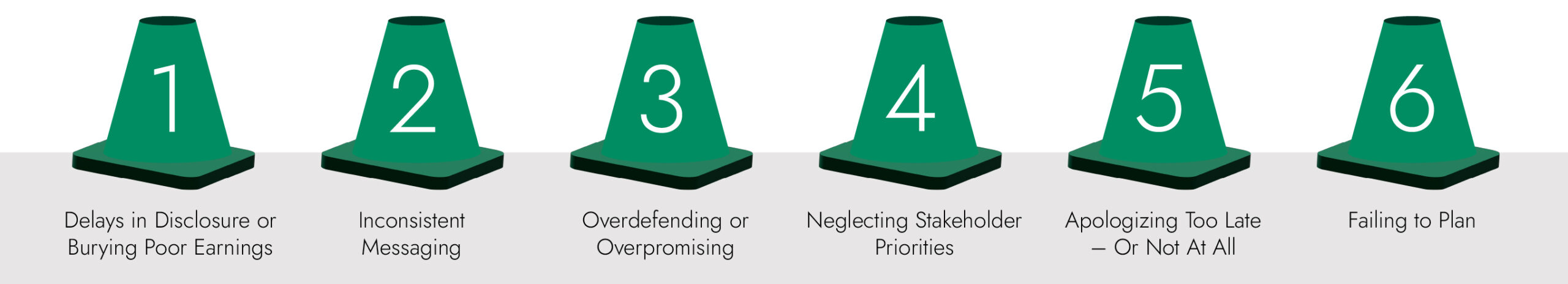

Crisis Communications Pitfalls That Escalate the Problem

Mistake #1: Delays in Disclosure or Burying Poor Earnings

Waiting too long to communicate an earnings shortfall can worsen market anxiety. Even a limited, initial disclosure – or just providing a reason for the delay – often earns more trust than silence.

This dynamic is particularly dangerous during earnings season, when investors are closely tracking guidance and forecasts. A delay without explanation can signal deeper operational or financial issues. According to the Rice School of Business, “…delayed earnings without a stated explanation prompt the most negative market reaction. As in so many areas of public relations, without a narrative, investors will infer a negative one of their own.”

Solution: Be up front with investors about why company earnings are short of expectations – do not bury the numbers at the bottom of an earnings press release. Investors are smart, and they’ll suss it out—and the lack of trust will be reflected in the share price. Even a brief, preliminary statement can buy goodwill and signal transparency.

Mistake #2: Inconsistent Messaging

Conflicting statements between executives, legal teams and IR – or across channels – can create confusion and diminish credibility. These disconnects may stem from siloed decision making or reactive, decentralized communication. In high-stakes situations, a poorly coordinated message can be interpreted not just as incompetence, but as dishonesty or obfuscation.

Solution: Draw up a crisis communications plan and delegate one or two spokespeople to handle all incoming requests. Prepare transparent communications and coordinate additional touchpoints where possible, such as executive videos and media interviews.

Mistake #3: Overdefending or Overpromising

A defensive tone or overly optimistic reassurances aren’t aligned with an accountable approach, and they can backfire if new information emerges or recovery takes longer than expected. American Airlines, for example, had to respond after a deadly crash between a passenger jet and an Army helicopter. Their first communications were transparent, empathetic and focused only on what they knew.

Solution: Stick with a transparent tone and focus on communicating the facts, owning up to what happened and taking accountability for the actions that will resolve the situation.

Mistake #4: Neglecting Stakeholder Priorities

Failing to address key stakeholder concerns such as long-term outlook, financial impacts or leadership stability may fuel selloffs or negative media cycles.

When key stakeholder concerns go unaddressed, particularly around the company’s long-term outlook, the financial implications of the crisis or the stability of leadership, it sends a message that the company is either out of touch or unwilling to engage.

Solution: As an IR leader, focus on investor priorities. Understand how they may be affected, whether it’s exposure to a damaged product line, delayed earnings or reputational risk, and speak directly to those issues. At the same time, don’t lose sight of the long-term strategy. Even if the short-term outlook is disrupted, reiterating the long-term vision helps contextualize the crisis and communicate confidence in the company’s direction.

Mistake #5: Apologizing Too Late – Or Not At All

Apologizing isn’t always necessary, especially when the crisis isn’t in management’s control. There is no reason to apologize in the case of a hurricane, for example. And for an employee scandal, management should take accountability, but an apology on the employee’s behalf isn’t necessary or appropriate.

In cases of real human tragedy, however, not apologizing can come off as lacking empathy.

Solution: Admit the mistake and show the human side of the company. Taking ownership is not just appropriate and the right thing to do – it shows a more relatable side to management.

Mistake #6: Failing to Plan

Perhaps the most damaging error is not having a proactive crisis communications plan. Without pre-approved templates, roles and messaging frameworks, companies lose precious time and make avoidable missteps under pressure.

Lacking a plan can lead to many other missteps – unauthorized statements to the media, scrambling at earnings, inconsistent messaging to stakeholders – that all stem from defaulting into a reactive cycle when a crisis happens.

Solution: Build a plan that includes spokespeople, timelines, steps for releasing information and specific contingency plans for every crisis that could potentially befall a company, based on unique risk profile and scenarios.

A Strategic Approach to IR and Crisis Communications

Crisis communications is about preserving long-term credibility and rebuilding short-term trust with the people who matter most to a company’s future: investors, partners, employees and customers. A thoughtful and transparent response goes beyond limiting risk to actually strengthening the reputation as a responsive, responsible and resilient organization.

At Arbor Advisory Group, we help companies navigate crises with clarity and confidence. Whether you’re in the middle of an unfolding event or looking to proactively strengthen your preparedness, we serve as a high-touch partner for your IR and executive teams, offering:

- Real-time integration during crisis events, ensuring seamless, strategic communications with investors and analysts.

- Strategic narrative development that reinforces your long-term value, even under pressure.

- Post-crisis reputation repair, including stakeholder re-engagement and long-term communication planning.

With decades of capital markets experience and a boutique approach that prioritizes executive partnership, Arbor Advisory Group helps companies manage high-stakes challenges with agility and authority. Learn more about our approach.