Short attacks can destabilize even the most well-run public companies. A clear strategy, consistent messaging and proactive investor engagement can help companies emerge from these events stronger and with enhanced investor trust.

Short attacks can destabilize even the most well-run public companies. A clear strategy, consistent messaging and proactive investor engagement can help companies emerge from these events stronger and with enhanced investor trust.

In November 2024, a leading AI-powered marketing technology firm became the target of a short-seller report. The report alleged misleading accounting practices and questionable data integrity, resulting in a rapid drop in the stock price and investor concern.

With Arbor Advisory Group as their strategic partner, the Company quickly regained control of the narrative, delivering a compelling investor response and emerging with a stronger market position.

The Story: Establishing the Company’s Market Position

The firm, publicly listed since 2021, specializes in AI-driven marketing solutions, leveraging advanced data analytics to enhance customer engagement. Since its IPO, the Company demonstrated robust growth and operational excellence, with 13 consecutive quarters surpassing its plan and its financial guidance. The Company’s commitment to innovation and transparency fostered trust among investors and positioned it as a leader in the marketing technology sector.

This strong foundation, alongside a clear strategic vision, proved crucial once the Company found itself at the center of a reputational firestorm.

The Scenario: A Short-Sell Attack Misleads the Market

In 2024, an investment research firm released a short-seller report accusing the Company of misleading accounting practices and raised concerns about data management. The allegations were unfounded but sensational – designed to trigger fear, distort perception and drive the stock price down for the benefit of short sellers.

Initially, the report worked. The market reaction was swift and severe, with the stock price dropping by double digits on the first day. Analysts and shareholders demanded clarity, and the Company’s credibility was called into question.

The risk wasn’t just reputational. The attack threatened to distract the management team, disrupt customer confidence and undermine the Company’s long-term value. Faced with a manufactured crisis, leadership turned to Arbor to regain narrative control and craft a transparent response to investors and stakeholders.

Our Role: Proactive Investor Engagement to Reaffirm the Strategic Vision

Proactive consistent communication coupled with strategic investor engagement is vital in navigating a crisis. The Arbor team embedded immediately with executive leadership, assessing the short-seller’s claims and coordinating with management ahead of defining both a strategic and tactical approach for communication.

- Comprehensive rebuttal: The Company conducted an internal review and released a detailed rebuttal addressing each allegation with factual evidence, emphasizing confidence in its accounting processes and controls.

- Leadership communication: The executive team engaged proactively, reinforcing the Company’s commitment to transparency and adherence to regulatory standards. Our team ensured that company leaders were fluent on the value drivers for stakeholders and prepared with clear talking points.

- Virtual Data Summit: Organized in just a few weeks, a high-production virtual investor event reiterated the strategic vision, addressed investor concerns head-on and demonstrated preparedness and stability. Arbor played a vital role in executing the investor event to help ensure clarity and strength of message.

The Outcome: Demonstrating Resilience and Financial Strength

The impact of this proactive and cohesive crisis communications strategy was immediate and helped stabilize the stock price within weeks. Sell-side analysts reaffirmed their guidance and targets, and the Company hit clear and measurable financial goals in the ensuing months:

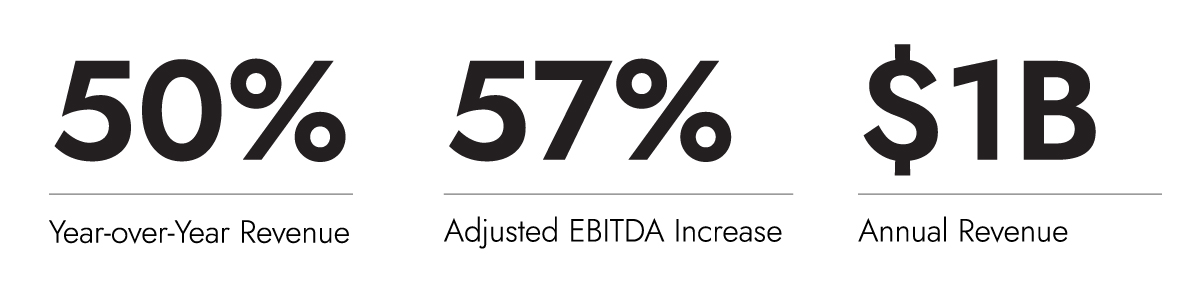

- Financial performance: In Q4 2024, the Company reported record-breaking revenue – up 50% year-over-year – and a 57% increase in adjusted EBITDA. The results not only exceeded expectations but directly contradicted core claims of the short report.

- Milestone revenue: The Company surpassed $1 billion in annual revenue, achieving its long-term goals one year early and signaling to investors that its vision remained on track and resilient despite external pressure.

- Strong market position: By leaning into leadership transparency and visibility, the Company renewed its position as a credible, high-growth player in the marketing technology space. Their robust financial results and active engagement with investors led to stock stabilization and rejuvenated confidence.

The Key Role of Crisis Communications in Investor Relations

Effective crisis management involves a proactive plan and a cohesive message, both in response to short-term concerns and to refocus the long-term strategy. Arbor’s crisis communication framework helps companies maintain control of perception and value:

- Consistent messaging: Clear, consistent communication from the executive team is crucial to maintain stakeholder trust. Our high-touch guidance ensures that every executive is confident in their delivery of key messages to investors.

- Preparedness for investor engagement: Meticulous planning and execution of investor events, even on short notice, demonstrate a company’s preparedness and stability – for the short- and long-term.

- Proactive stakeholder communication: This ensures that the company maintains control of the narrative and that investor concerns are promptly addressed. We prioritize the investor perspective, tailoring communications to strengthen trust, credibility and shareholder alignment.

With decades of experience in investor relations, corporate communications and crisis management, Arbor offers strategic guidance to navigate complex situations, ensuring that companies not only weather crises but strengthen their market position in the process.

Learn how Arbor can support your team in preparing for unexpected crises with confidence and clarity.