Today, investor relations (IR) professionals face unprecedented complexity. Markets shift faster, and the root cause of changing valuations may be even more opaque due to data-driven trading. Investor expectations for timely communications are rising even as they encounter a challenging environment that at times changes on a daily basis.

Today, investor relations (IR) professionals face unprecedented complexity. Markets shift faster, and the root cause of changing valuations may be even more opaque due to data-driven trading. Investor expectations for timely communications are rising even as they encounter a challenging environment that at times changes on a daily basis.

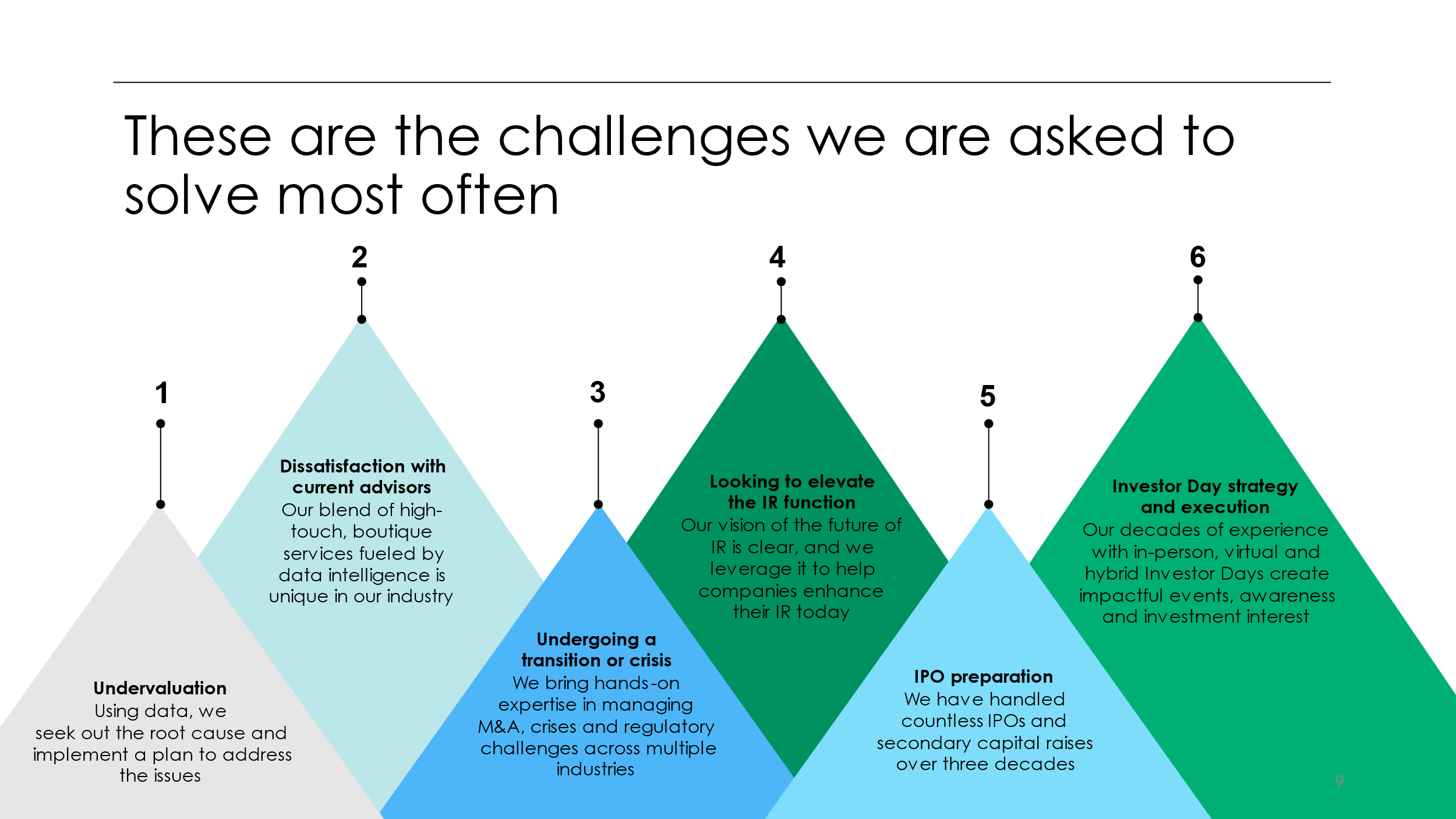

In this article, we focus on six challenges that we commonly encounter – and explain why an approach rooted in long-term strategy remains the best solution.

1. The Valuation Gap: Understanding & Addressing Undervaluation

Many companies experience a persistent gap between management’s perceived long-term value and current market valuation. One of the most common frustrations in IR is the sense that strong fundamentals are not translating into stock performance.

Today, quantitative investment strategies account for over 60% of daily trading volume in U.S. equity markets. As more market activity becomes driven by passive and quantitative funds, including firms using proprietary metrics, it becomes harder for executive teams to pinpoint the fundamental issues driving underperformance.

Without a coherent explanation for this gap, executives may default into a cycle of non-strategic, reactionary decision making and misaligned investor communications. At Arbor, we cut through the noise by diagnosing valuation gaps through data. We use market and peer analysis to isolate valuation drivers, then apply factor-based tools to understand how sector dynamics, investor preferences and performance signals interact in real time. This allows our clients to recalibrate both investor messaging and strategic priorities to ensure that long-term value is being persuasively communicated.

2. Dissatisfaction with Current IR Advisors: Seeking Strategic Partnerships

As data-driven IR becomes a greater priority, a slow approach to adapt can become a major source of frustration for executive leadership. IR teams accustomed to working with a passive advisory and communications firm may struggle to provide the proactivity, data intelligence and in-depth strategic insight needed to keep up with today’s markets.

Arbor’s approach seeks to go beyond a traditional IR advisory role by providing high-touch, boutique services and solutions backed by sophisticated quantitative capabilities. Our team learns every client’s business from the inside out, an indispensable foundation to proactively identify, understand and address investor concerns.

3. Navigating Transition and Crises: Ensuring Stability and Confidence

Nothing puts the spotlight on IR like a major strategic event that has the potential to shape public perception for years to come. During significant mergers and acquisitions, executive leadership changes, unexpected PR crises or the planned release of negative news, the right IR strategy is critical for not just maintaining investor confidence but shaping the underlying market narrative.

Timely and transparent communication are critical for maintaining investor confidence, and IR teams need to be ready to act in strategic alignment with leadership. Careful planning can help set the stage for a successful response, and IR teams will also want a structured process for responding to unpredictable events that can damage a company’s reputation. For example, Volkswagen’s stock dropped 30% in the immediate aftermath of a diesel emissions scandal back in 2015.

Arbor’s approach prioritizes adaptable preparation:

- Develop preemptive crisis communication playbooks tailored to specific events.

- Craft investor messaging strategies that emphasize transparency, confidence and long-term vision. This provides both an anchor for communications and a starting place for crisis response.

- Leverage data-driven insights to anticipate investor sentiment shifts and proactively manage narratives.

4. Elevating the IR Function: Evolving to IR 2.0

In some instances, investor relations is treated as a compliance checkpoint, tasked with disclosures and earnings call logistics rather than empowered as a strategic lever for the business. Today, the stakes are higher; neglecting to adopt an elevated IR strategy risks leaving real value on the table.

IR teams must operate at the intersection of data, storytelling and management strategy. The most effective IR functions shape perception year-round, delivering consistent corporate messaging to support business objectives.

At Arbor, we help companies make the leap to “IR 2.0.” This data-driven framework is designed to directly target the unprecedented challenges and opportunities facing IR today. We pair deep data intelligence with hands-on human expertise to surface the most important insights about how the market perceives a company. From there, IR can inform the executive team, support the board and engage investors with a clear, cohesive message rooted in how the marketplace assesses value.

5. IPO Preparation: Overcoming Timelines and Readiness Hurdles

An IPO is often framed as a single event, but success depends on how well a company prepares for everything leading up to and following the listing. Many organizations underestimate the runway required to align internal processes, refine investor messaging and adapt to the structural realities of being a public company. In practice, IPO readiness should go beyond checking compliance boxes to focus on building a foundation for sustainable, long-term success. We recommend that companies plan an 18-24 month runway to prepare for the most impactful IPO possible.

Arbor has developed IPO roadmaps that balance financial storytelling, regulatory readiness and stakeholder alignment. We support leadership through the cultural transition that often accompanies an IPO, offering guidance on brand messaging, employee communications and the strategic rationale that will carry forward post-offering.

6. Mastering Investor Day Strategy and Execution

Investor Days are evolving quickly. As in-person attendance declines and more investors tune in remotely, the stakes for virtual engagement are higher than ever. A static deck and simple webcast are no longer sufficient to make a lasting impression across a broad and hybrid audience. Without a clear strategic narrative communicated with elevated production value , even the most important messages risk landing flat.

The most effective Investor Days function more like campaigns than events. A memorable Investor Day is tightly produced, thoughtfully scripted and built to engage a hybrid audience: on-site and remote. And they communicate a clear strategic narrative before and after the event to reinforce the concept of consistent messaging. Companies that invest in this approach will have a unique strategic inflection point to lay the groundwork for sustained engagement.

Arbor partners with IR and executive teams to deliver Investor Days that connect. We align messaging with long-term strategy, shape content that tells a compelling story and coordinate actions across marketing, PR and leadership to maximize reach and post-event momentum.

Learn how expectations are changing for modern Investor Days.

Why IR Challenges Are More Complex Than Ever

Macroeconomic volatility and regulatory uncertainty have raised the stakes for investor communications. IR teams must not only stay on top of changing expectations, but also understand the priorities of their target investors, communicate a differentiated value proposition with clarity across every touchpoint. This includes professional video, compelling visuals and messaging tailored for digital platforms like LinkedIn, email and investor portals.

These challenges are most pronounced when IR lacks a long-term roadmap. Developing an effective investor thesis, content strategy or Investor Day plan takes time and must be cultivated well in advance to support long-term business goals.

How a Proactive, Data-Driven Approach Can Drive ROI

A forward-looking IR strategy begins with clear, diagnostic insights into how the market is valuing the business. Companies that isolate key valuation drivers are in a stronger position to address misalignment before it hardens into a narrative.

Translating data into investor confidence requires a narrative that’s grounded, transparent and built for longevity – particularly during times of volatility, when fundamentals are most critical. Framing performance in a way that speaks to investor priorities not only improves credibility but helps earn a more stable market perception over time.

Cross-functional integration is the key to translating this optimized narrative into an actionable long-term strategy. When IR works closely with corporate strategy, marketing and executive leadership, it matures from a supporting function to a strategic engine for the business.

Arbor advocates for a campaign-based mindset that draws on insights from marketing, where investor messaging is treated not as a one-off deliverable but as part of a coordinated communication plan that builds and reinforces over time.

Taking a Partner Approach to Investor Relations

In reality, most IR challenges do not just stem from external market conditions, however challenging they may be. They are often rooted in the absence of strategic guidance early in the process. When companies prioritize short-term execution over long-term alignment, messaging becomes reactive and opportunities to shape investor perception are lost. This can erode investor confidence, and that’s only exacerbated during periods of market uncertainty or transition.

A true IR partner can shift this trajectory by helping companies take a longer view. When valuation analysis, investor engagement and communication strategy work in concert, IR becomes an engine for growth.

At Arbor, we embed this long-term partnership approach into every engagement. We work closely with leadership to distill complex business objectives into clear, compelling investor messaging. From there, we dig in to help teams build a flexible plan, navigate a changing equity market, build trust and stay ahead of investor expectations.

Learn more about Arbor’s strategic advisory services.