Artificial intelligence has rapidly evolved from a back-office efficiency tool to a front-line strategic driver. AI isn’t just changing how markets move – it’s reshaping how companies must communicate, analyze data and engage with the investment community. Investor relations teams can take advantage of efficiencies, data gathering to become more strategic in their roles.

Artificial intelligence has rapidly evolved from a back-office efficiency tool to a front-line strategic driver. AI isn’t just changing how markets move – it’s reshaping how companies must communicate, analyze data and engage with the investment community. Investor relations teams can take advantage of efficiencies, data gathering to become more strategic in their roles.

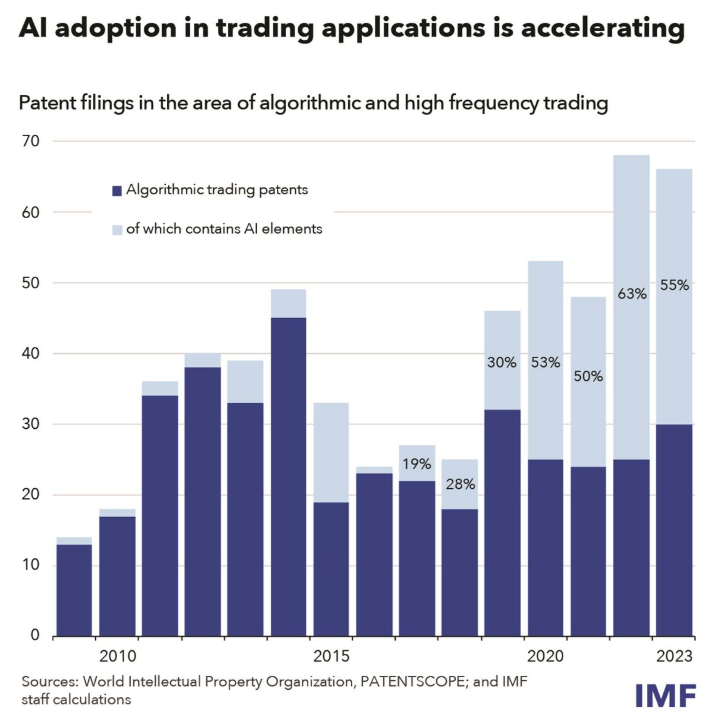

With algorithmic trading accelerating and machine learning models influencing investor behavior at unprecedented speeds, IR professionals are being called upon to interpret a broader universe of data at the same speed as their investors but also tailor narratives that can be understood and prioritized by everyone: AI systems, executive leadership and astute investor groups. The result: a more complex, faster-moving and data-saturated IR landscape.

In this post, we explore how AI adoption is reshaping investor relations and what forward-thinking IR teams can do today to stay competitive and connected with the market.

AI Accelerates the Data Shift

With the rising importance of quantitative investors using algorithmic trading, IR has already become significantly more data-driven than in the past. This trend will continue to accelerate with the rise of AI and machine learning models (ML).

Several distinct challenges will appear for IR teams to leverage the new AI and data-driven toolset, but they also present a unique opportunity to drive value. Here’s how IR leaders can prepare to meet the AI wave:

- Upskilling to address rising technological complexity as AI accelerates the knowledge gap between companies and investors. This puts the responsibility on IR teams to hone their skillset in order to understand trends, glean insights out of broad datasets and provide actionable, strategic feedback for the executive team.

- A growing opportunity to improve efficiency. Once IR leaders reach a certain mastery of AI tools and capabilities, they’ll unlock time savings in addition to greater insights into the marketplace. Earnings preparation becomes more efficient when you can sift through large volumes of data and analyze hundreds of documents to understand market sentiment in minutes.

- Properly addressing compliance and security concerns. There are novel security risks associated with feeding large volumes of potentially proprietary data into AI models. Unless an organization has developed its own large language model (LLM), non-public information should be treated very carefully. While secure, walled-off AI tools are available, IR teams will want to be proactive about recognizing this threat vector as they scale up the use of AI. This requires carefully defined best practices, proactive education and meticulous technology selection.

How AI Could Supercharge Algorithmic Trading

In IR, the demand for more sophisticated AI-ready data processing is only one side of the equation. IR leaders may also be charged with learning how to evaluate investor sentiment and craft narratives for investors who are employing their own AI tools.

First, AI will play a role for more traditional, passive investors, who can employ new tools for fundamental analysis and portfolio management workflows. Second, the use of AI/ML models will mean that the notorious “black box” of algorithmic investing decisions will only become more opaque to scrutiny.

Regardless of how quickly investors are deploying these tools, it’s critical for IR professionals to understand the proliferation of available data and how it’s being applied so that they can close the information gap with a compelling, data-driven narrative.

Source: International Monetary Fund (IMF) Blog

Research from the IMF shows that AI is already driving a spike in trading volume, and prices may react more quickly in an increasingly AI-influenced market. As stated by the IMPF, for example, “the release of the complex and lengthy minutes of Federal Reserve meetings is an example where AI could provide a trading signal faster than any human trader could…Since 2017 and the introduction of [large language models (LLMs)], the movement of US equity prices 15 seconds after the release of the Fed minutes seem to be more consistently in the direction of the longer-lasting movement seen after 15 minutes, in contrast to the apparently uncorrelated movements in the pre-LLM period.”

With AI, the quantitative landscape for investor relations is more complex than ever. However, the core mission for investor relations remains the same: combining art and science to add layers of analytical complexity, and also to understand the metrics that truly matter to investors and the narratives they inform.

How “AI as Analyst” Will Shape Investor Communications

Investors are leveraging natural language processing (NLP) tools to analyze earnings call transcripts, and these applications will continue to expand. AI-driven tools are increasingly used by institutional investors to analyze financial disclosures, detect sentiment shifts and even scrutinize tone and word choice in executive commentary.

For example, AI-powered research tools can scrape and analyze company websites for key data points. Tighter alignment with marketing (see below) is instrumental for keeping IR sites optimized for both traditional search engines and AI, so that the desired messaging is returned at the top of both search results and AI research.

For IR professionals, this shift means that communicating with investors is not just about having the right message, but understanding how that message will be received, processed and ranked by AI systems. Companies will face increasing pressure to ensure that investor relations materials (including earnings releases, investor presentations and transcripts) are optimized for AI-driven research.

Companies will face increasing pressure to ensure that investor relations materials (including earnings releases, investor presentations and transcripts) are optimized for AI-driven research.

Crucially, companies can also leverage AI to help keep up. According to the Wall Street Journal, “finance teams in general have been slower to apply AI than other departments…but they have begun to make an exception for investor relations.” Companies are already using AI to:

- Anticipate investor questions.

- Refine messaging based on preemptive sentiment analysis (ie. flagging words that could be interpreted negatively by algorithmic trading models).

- Forecast market reactions based on historical trends.

“Indeed,” notes the Wall Street Journal Report, “44% of investor-relations professionals have already folded AI into their companies’ IR programs, primarily to create written content, according to a March survey from the National Investor Relations Institute.”

Investor Relations Trends: Innovative Storytelling, Opaque Valuation Drivers, Shifting Regulations

From shifting valuation models to new approaches to executive visibility, the way companies engage investors is also evolving. As expectations shift, IR teams must adapt their strategies to ensure their messaging resonates.

More Sophisticated Video Content for Strategic Social Media Communications

IR professionals are employing social media strategies that go far beyond earning press release headlines, incorporating tailored, personalized content and custom graphics to reinforce company narratives for both institutional and retail investors.

Content from individual executives provides a unique opportunity to increase visibility while communicating directly with investors. The Times reports on some instructive examples. In one post, Blackstone COO Jon Gray (a “master of the ‘walk and talk’ video”) “teases that he has a secret adviser to help him to prepare for earnings day. The consultant in question is his dog, Luna.”

Deloitte “hired Lara Sophie Bothur as its first corporate influencer,” who “visits tech firms, robotic labs and innovation hubs and leaves with a vision for the future of technology to share with her LinkedIn followers, making 400 million impressions.” With individual posts garnering over 800,000 interactions, these strategic social media plays have the potential to far exceed the scope of traditional IR outreach mechanisms.

This opportunity to broaden the playing field also introduces new risks. The Times notes that “leaders are now expected to be charismatic communicators without teetering into the kind of forced informality that a younger audience might deem disingenuous or investors may consider sloppy.”

Deeper Analysis of Valuation Drivers

Understanding fundamental valuation drivers will be more critical than ever for investor relations teams. As passive investment flows and algorithmic models increasingly influence stock performance, traditional, fundamentals-based valuation frameworks can only go so far in explaining valuation outcomes.

This disconnect can leave companies struggling to reconcile long-term value creation with near-term stock price volatility. For IR teams, the challenge is not just explaining financial results, but proactively identifying and addressing the factors influencing these “valuation gaps.”

Digging deeper into quantitative analyst models will be a key pillar of any effective solution, including a granular understanding of how key institutional investors weigh growth versus profitability, sector-specific KPIs and relative valuation to peer companies. More broadly, however, the real challenge remains synthesizing these quantitative insights with qualitative knowledge (such as investor feedback and conference call questions) to answer the “why” behind the valuation story. From there, IR teams can put together a solution based on actionable intelligence – the true power behind a tailored IR strategy.

We take a deeper look at “minding the valuation gap” here.

The Answer: Communicating a Cohesive Company Story

As we see it, there is still a unifying theme to address the trends highlighted above, even those as seemingly disparate as machine learning for valuation and personal executive videos: companies that communicate a clear, strategic and data-driven growth story will be best positioned to nurture and maintain investor confidence.

Think Like A Marketer to Harness the Power of Storytelling

Even as the prevalence of data grows, IR is not just about reporting metrics but enhancing investor understanding. Leading IR teams are adopting a marketing mindset, leveraging real-time investor feedback, strategic audience segmentation and proactive campaign-based messaging to optimize their outreach. This approach ensures that companies are not only informing investors but actively influencing their understanding of corporate value. We take a deeper dive into what investor relations can learn from marketing here.

Leading IR teams are adopting a marketing mindset, leveraging real-time investor feedback, strategic audience segmentation and proactive campaign-based messaging to optimize their outreach.

Invest in Quality for Communications Materials

From executive videos to IR presentations, high-quality investor materials are no longer a one-time-use asset; they serve as foundational content that can be repurposed across channels to extend their impact. A well-produced investor presentation, for example, can be adapted into bite-sized content for newsletters, reformatted for social media and used to enhance IR websites.

These materials help ensure that key messages reach investors in different formats, meeting them where they are and reinforcing the company’s strategic vision over time. For example, cornerstone IR events such as investor days offer a unique opportunity to generate high-value content that can be leveraged well beyond the event itself. Video excerpts, executive insights and data visualizations from these sessions can be repackaged to sustain investor engagement long after the event has ended. We take a deeper look at the best ways to evolve your investor communications here.

Harness Data to Identify and Solve Valuation Gaps

Solving potential valuation gaps requires more than acknowledging market misalignment. Data is key, but must be used in a focused manner to uncover the root causes of investor perception issues. A comprehensive valuation assessment is the best foundation for systematically learning which financial and operational metrics investors prioritize, where miscommunication may be leading to undervaluation and how a company can refine its messaging to close the gap.

Leveraging detailed market analysis and investor feedback is the only reliable way for companies to develop truly targeted IR strategies. In some cases, the right approach will require shifting the focus to underappreciated performance indicators. In others, it will necessitate repositioning the investment narrative to better align with sector-specific valuation frameworks. For a detailed example, explore our case study on how we leveraged integrated quantitative and qualitative expertise to diagnose and solve one performance brand’s valuation gap.

IR 2.0: Engaging Investors with a Cohesive, Connected Strategy

Successful investor relations in today’s dynamic environment demands quantitative capabilities that are carefully integrated with a proactive approach to nurturing confidence and credibility over time.

This philosophy is the foundation of the approach we call IR 2.0. By combining best-in-class communications strategies, high-quality investor materials and innovative market intelligence, IR teams can shape a stronger, more credible growth story that resonates with stakeholders.

Contact us to learn more about how IR 2.0 can help address your challenges in 2025.